It would be an understatement to say that, back in April 2020, we had some free time on our hands. Always eager to use my time productively I was on the hunt for creative ways to learn new things. That led to a 1-year MasterClass subscription and, since then, I’ve completed 12 MasterClass courses in 12 months.

This is my review of those 12 classes.

Jimmy Chin

Adventure Photography

20 lessons

Length: 4 hours, 10 minutes

I’m a huge fan of Jimmy Chin and actually ran into him once while climbing The Gunks in upstate New York. We were both climbing similar difficulty routes that day so I’ll always be able to pretend that we climb at the same level. This MasterClass was highly dynamic because it mixed on-location climbing shoots with focused lessons on overcoming different photography challenges. It was a great balance of theory, real-world practice, and entertaining stories from Jimmy’s countless adventure. My rating: 4/5 stars

Steve Martin

Comedy

25 lessons

Length: 4 hours, 41 minutes

Steve Martin is a comedic legend and I was excited to take his class. Like most MasterClasses, it’s a blend of personal story and targeted advice. There are a few great workshop segments where he gives feedback to a group of four budding comedian’s acts. I also enjoyed how they spliced in clips of Martin’s old performances to illustrate important points. My biggest complaint is that he occasionally seems unprepared or unsure what he’s going to say. My rating: 3/5 stars

Jon Kabat-Zinn

Mindfulness and Meditation

20 lessons

Length: 6 hours, 31 minutes

I’ve been practicing meditation for the past 5 years but I never really had a good introduction that tied everything together. This is that course. It’s maybe the only MasterClasses that I’d consider paying full price for. Jon is the OG of modern western meditation — he has a PhD in biology from MIT and was one of the first people to organize formal scientific studies of meditation. I loved this course because it struck a great balance between theory and guided meditations. By the time a theory session is over, you’re feeling energized to begin the next meditation. My rating: 5/5 stars

Daniel Pink

Sales and Persuasion

16 lessons

Length: 2 hours, 57 minutes

I’ve never read any of Daniel Pink’s books, so I can’t say how they compare to the MasterClass. I was intrigued by the course title “Sales and Persuasion” because I think it’s one of those areas that we all can improve. My biggest course takeaway was the importance of empathy in persuading others. The course leaned heavily on data from human behavior studies, like loss aversion, attribution error, and power positions. I love those types of behavioral studies but they can be a double edge sword when relied on too heavily, which Pink does at times. My rating: 3/5 stars

Neil deGrasse Tyson

Scientific Thinking and Communication

13 lessons

Length: 2 hours, 14 minutes

My biggest complaints about this course are the length (it’s a bit short) and deGrasse Tyson’s constant need to toot his own horn (it’s a bit off putting). With that said, I thought the lessons on asking questions and speaking to your audience were valuable. I also liked his point that it’s just as lazy to dismiss an idea as it is to blindly accept it. Keep a skeptical, scientific mind and ask questions. My rating: 2/5 stars

Frank Gehry

Design and Architecture

17 lessons

Length: 2 hours, 32 minutes

This was one of my least favorite classes. It was mostly Gehry reminiscing about old projects in no specific order. There were a low amount of learning moments. On the plus side, he’s definitely honest and doesn’t pretend to tell you that his way is the only way. My rating: 1/5 stars

Judd Apatow

Comedy

32 lessons

Length: 6 hours, 34 minutes

I suppose it’s no surprise that Judd Apatow’s MasterClass was the longest of the bunch. The theme was mostly film writing and producing — fields that I’m not planning on entering anytime soon. With that said, I found this MasterClass extremely fascinating. It was a cool behind-the-scenes look at how movies are made and how comedic moments are birthed. I like how he went down into the weeds, talking about details like budgeting, developing scripts, casting, and improv. I also loved how the class used clips from Apatow’s movies (Knocked Up, This is 40, Trainwreck) to act as lesson launch points. My rating: 4/5 stars

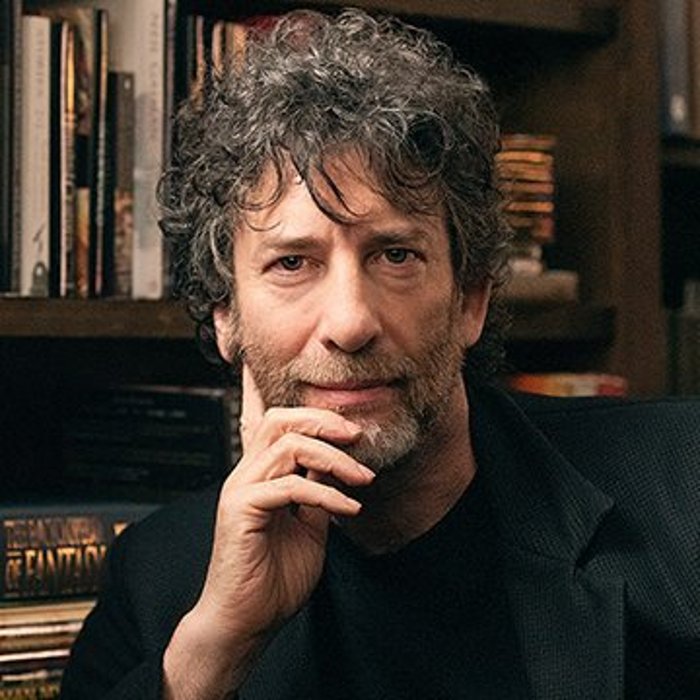

Neil Gaiman

The Art of Storytelling

19 lessons

Length: 4 hours, 49 minutes

I could listen to Neil Gaiman read the dictionary. His poise, style, and accent are absolutely enthralling. My favorite lessons were when he casually pulled one of his books off the shelf, read a passage, and proceeded to reveal its backstory. Similar to Apatow’s class, it felt like a secret glimpse into the world of creativity. Neil also gave some solid tactical advice for character development, working through writer’s block, and finding your voice. My rating: 4/5 stars

Bob Iger

Business Strategy and Leadership

13 lessons

Length: 2 hours, 11 minutes

I was excited for this class after reading Iger’s incredible book “The Ride of a Lifetime”. Unfortunately, his MasterClass was a disappointment. The book was full of interesting stories yet the class glazed over them. Skip this class and read the book. My rating: 2/5

Sara Blakely

Self-Made Entrepreneurship

14 lessons

Length: 3 hours, 30 minutes

Blakely is the founder of Spanx, which made her the youngest self-made female billionaire in the world and her story is compelling. Her story is wisely weaved throughout the class and is balanced by personalized lessons in entrepreneurship. The lessons I pulled from this class were: starting small can lead to big things, failure is the norm not the exception, and how to think creatively while solving problems. I think the class’s biggest achievement was putting a new twist on old business topics. My rating: 4/5 stars

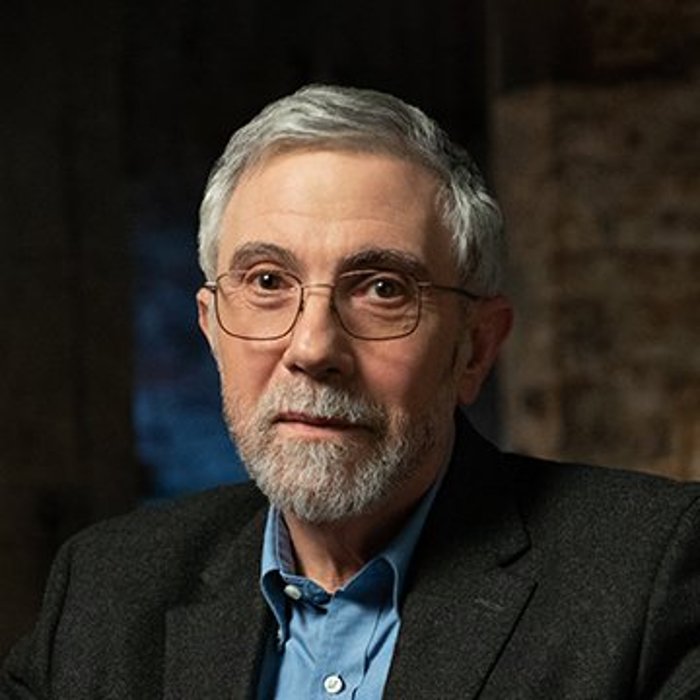

Paul Krugman

Economics

22 lessons

Length: 3 hours, 56 minutes

I haven’t taken an Economics class since my freshman year of college with Professor “Crazy Willy”. He was notorious at the University of Delaware because he was extremely strict and objectively crazy. He took pride in it. He docked 5 points off your final grade if you arrived late to class and I vividly remember him chugging a students’ Red Bull in the middle of a lecture. Krugman’s class was notably less crazy but entertaining nonetheless. It’s a great introduction to many of the topics we hear on the news but know very little about (e.g. The Fed, healthcare, economic bubbles). I recommend it to anyone who has interest in how modern economies actually function. My rating: 4/5 stars

Chris Voss

The Art of Negotiation

18 lessons

Length: 3 hours, 4 minutes

This was my first MasterClass and it’s a great one. Voss’s book, Never Split the Difference, is my favorite book on negotiation. It’s one of the few books that I’ve read on Kindle and listened to on Audible. The class does a good job of mixing role playing to help the theory come alive. MasterClass also tries to tie in thematic elements to each class, and they aptly wove in a crime solving ambiance (Chris was a former FBI hostage negotiator). I recommend this class to anyone interested in improving their negotiation skills. My rating: 5/5 stars

Conclusion

Was I happy with my MasterClass subscription? Absolutely. Would I pay full price ($192 / year, billed annually) for one? Maybe.

The classes were educational and entertaining but the price tag is a bit steep, especially if you’re only interested in one or two classes.

I was able to get my membership with a friend during a 2020 BOGO special, making the half price point more palatable. If you’re interested in any of the above classes (or the 100+ course catalog), my recommendation would be to find a friend who’s interested and share an account.

Happy learning.